Crypto Frontiers: Decoding the New Digital Wave

Unveiling Crypto Investment, Career Dynamics, and Youth Innovation in the Web3 Era

by Nicole CHU

From Satoshi Nakamoto's groundbreaking Bitcoin whitepaper in 2008 to today, cryptocurrency has rapidly evolved—from an obscure digital experiment into a powerful global phenomenon—transforming finance, technology, and even culture itself. Born out of the global financial crisis, cryptocurrency promised a new form of secure, transparent, and decentralized transactions free from banks or government intervention.

To fully understand this transformative journey, it's essential to explore cryptocurrency's growth across three pivotal periods: its early experimental years (2008–2013), rapid mainstream growth and turbulence (2014–2017), and the era of institutional adoption, innovation, and regulatory maturity (2018–present).

2009-2013

On October 31, 2008, a user with the pseudonym Satoshi Nakamoto published the paper "Bitcoin: A Peer-to-Peer Electronic Cash System," introducing the Bitcoin concept. In early 2009, Satoshi Nakamoto mined the first block of Bitcoin (called the "Genesis Block"), and Bitcoin initially attracted the attention of cryptography enthusiasts and early technology adopters. In May 2010, programmer Laszlo Hanyecz used 10,000 Bitcoins to buy two Papa John's pizzas, which became the first real-world transaction of Bitcoin, marking the transition of Bitcoin from theory to practical application. In March 2013, Bitcoin's total market capitalization exceeded $1 billion for the first time, began to attract mainstream attention

2013–2017

From 2013, cryptocurrencies moved toward mainstream adoption as Bitcoin surpassed $1,000 for the first time. In 2014, the largest exchange Mt. Gox was hacked and collapsed, causing Bitcoin's price to crash by 80% and prompting enhanced industry security measures like advanced encryption, offline cold storage. Ethereum launched in 2015 and quickly rose to prominence as the world's second-largest cryptocurrency, quickly enabling innovations like smart contracts, NFTs, and DeFi. The crypto market reached a historic boom in 2017, with Bitcoin surging from less than $1,000 at the start of the year to nearly $20,000 by year's end—a remarkable 2000% increase. The "Bitcoin pizza," once purchased for 10,000 Bitcoins, would have been valued at over $200 million at this peak. Hundreds of new cryptocurrencies emerged through Initial Coin Offerings (ICOs), expanding the crypto ecosystem and drawing unprecedented worldwide attention.

2018-Now

In early 2018, the ICO (initial coin offering) bubble burst, triggering the first large-scale market crash. The price of Bitcoin once fell to about $3,000. As a result, global regulators have significantly strengthened supervision. China has completely banned cryptocurrency trading and mining, and the United States and other countries have also strengthened regulatory norms. Since then, the market has gradually turned to technological innovation, and DeFi (decentralized finance) and NFT (non-fungible tokens) have risen rapidly. In 2024, the U.S. Securities and Exchange Commission (SEC) has historically approved the listing of the first batch of Bitcoin spot ETFs, and the industry has gradually gained compliance and mainstream financial recognition. At the end of 2024, the price of Bitcoin will exceed the $100,000 mark.

Initially adopted by tech enthusiasts, libertarians, and risk-seeking investors, its user base soon expanded rapidly, growing beyond niche communities and evolving into a diverse, global ecosystem of active participants. The cryptocurrency ecosystem is rapidly growing these days, attracting a diverse range of participants, for example, wealth-seeking investors, opportunity-driven professionals, and innovative young members of Generation Z. Motivated by economic freedom, technological innovation, and personal aspirations, these participants actively engage with the Web3 movement, accelerating the expansion of cryptocurrency and decentralized networks. However, this evolving landscape also presents significant challenges, including extreme price volatility, regulatory uncertainty, environmental and energy concerns, as well as frequent fraud and security breaches—issues that pose serious risks to participants and continue to provoke widespread debate and public concern.

To better understand this emerging world, we must explore the experiences of its diverse participants. This project undertakes this exploration through three articles: the first presents a collective portrait of cryptocurrency investors, examining who benefits and who bears the costs; the second analyzes how Web3 professionals and investors navigate career opportunities and risks; the third focuses on university communities and Gen Z, investigating their role in shaping and leading the future of Web3.

Who Is Reaping the Rewards, and Who Is Being Reaped?

A Collective Portrait of Cryptocurrency Players

Since 2020, TJ Chen made money in the cryptocurrency market through stablecoin arbitrage strategies, a practice often referred to as "brick-moving," earning profits "as if picking up money." "When the market was good, just during a lunch break, my account could skyrocket by a million," he said. From the perspective of seasoned crypto veterans, that was a golden era: the market had not yet become hyper-competitive, information gaps were everywhere, and those who spotted opportunities and dared to take risks often became rich with ease.

Four years later, at the end of 2024, Grath Yang stepped into the world of cryptocurrency with high hopes and a starting capital of 10,000. A complete novice in the crypto space, he was thrilled by the "wealth secrets" he had learned from Youtube. "However, after just two months, I was left with only 1,000 of my initial capital, and I decided to step away for now." It was then he realized that he was merely another cog in the "retail investor" ecosystem, completing the "mandatory lesson" for new players entering the crypto world.

According to a survey by Triple-A, with a compound annual growth rate (CAGR) of 99%, the growth in cryptocurrency ownership far surpasses the growth rate of traditional payment methods, which averaged only 8% from 2018 to 2023. Meanwhile, data from Binance Research shows that the cryptocurrency industry's market capitalization grew by 96.2% year-on-year in 2024.

The growth in global users is also remarkable. Triple-A’s report shows that approximately 6.8% of the global population owned cryptocurrencies in 2024, translating to about 562 million people. This represents a 33% increase compared to the 420 million users in 2023. This indicates that cryptocurrencies are gradually penetrating a broader user base, attracting an increasing number of new entrants to the market.

As the market continues to expand, more and more investors are pouring into this centralized or decentralized cryptocurrency arena, where struggle, risk-taking, and opportunism have become daily routines for participants. Within this ecosystem, the cryptocurrency player community exhibits astonishing "species diversity": some are reaping the rewards, some are being reaped; some remain steadfast, while others retreat. Who are the hunters, and who are the hunted? Beneath the surface of this seemingly thriving jungle, each player is unfolding their own unique survival story.

8 Years in the Crypto Space: The Advancement of a "Coin Scientist"

TJ Chen, 35, began exploring cryptocurrencies in 2017. Over the past 8 years, he has experienced several cycles of bull and bear markets and gradually transitioned from being a researcher and engineer at an exchange to becoming a freelancer and a knowledge-sharing content creator on Bilibili.

Chen refers to himself as a "Coin Scientist," representing a group of individuals at the forefront of crypto technology and ideology. These "Coin Scientists" deeply engage in cryptocurrency research, understand its technical foundations and economic models, and are often adept at profiting from their insights. Through technical expertise, they identify opportunities and breakthroughs within the complex on-chain ecosystem.

Several years ago, Chen was active on a stablecoin trading platform conducting arbitrage, which became one of his most profitable ventures. At the time, Chen managed an asset management account worth over 50 million RMB (approximately 10 million USD). "Back then, we could repeatedly use stablecoins for arbitrage, like swapping USDT for USDC and then USDC for USDT. Although the price differences were small—like 0.99 to 1.01—high-frequency trading on a large enough scale still yielded significant profits," he said.

In addition to arbitrage, the platform's "trade mining" mechanism also brought unexpected returns. "The platform rewarded trading users with a token called CRV. At that time, CRV increased 20-fold in value. While conducting arbitrage, I also profited from the token's price appreciation. Over three months, this operation earned the account nearly 20 million RMB," Chen said.

However, looking at today's market, he said that competition has become significantly more intense. "There used to be fewer 'scientists,' not many people like me, so there were plenty of opportunities. But now, the field is highly competitive, and making money has become much harder."

As a graduate of the Business Intelligence program at the University of Queensland, Chen has a solid foundation in mathematical analysis, which allows him to focus more on researching the technical fundamentals when investing in blockchain projects. For example, he often examines the logic of smart contract code to identify potential vulnerabilities.

In the primary blockchain market, early-stage investments are often regarded as opportunities for high returns because investors can enter at a low cost before a project gains widespread attention.

Chen said that this “Early Bird” investment approach is not merely based on luck but requires thorough research and rational judgment. "Blockchain is fundamentally built on a set of mathematical algorithms and formulas, and these formulas directly determine the operational logic and stability of a project," he explained. "Before investing, we need to verify whether these mathematical formulas and technical foundations are correct, reasonable, and capable of withstanding practical application."

Nonetheless, risks still exist. Chen said that even with a solid technical foundation, investment failures cannot be entirely avoided. The success of a blockchain project is not solely dependent on its technology but also involves factors such as market conditions, team execution, and community support.

"There was a project led by a Chinese team of MIT students. The team’s background seemed impressive, and their formulas and technical models appeared to be sound. At the time, I invested $10,000, but I ended up losing almost everything," he said.

"Even though our understanding of projects may be deeper than that of the average person, it doesn’t mean every investment will be profitable."

In recent years, Chen has also been passionate about sniping meme coins on-chain, describing it as “an exhilarating game of speed and precision”.

"Meme coins are a traffic-driven economy and heavily depend on hype. Everyone knows the project team might rug-pull, but people still jump in for the potential high returns."

Compared to mainstream cryptocurrencies like Bitcoin and Ethereum, which are centered around clear technological visions and practical applications, meme coins primarily derive their value from traffic, hype, and market sentiment. As a result, they are highly risky, with their value entirely dependent on market emotions, making them prone to speculative bubbles. Prices may skyrocket, but they can also quickly collapse to zero.

"It's like a game of 'fastest wins.' Sniping meme coins is essentially a race; whoever gets in early at a low price wins, while those who are slower end up buying at a higher price—or worse, getting stuck holding the bag," said Chen.

When a meme coin is newly launched and only available on decentralized exchanges (DEX), users can perform on-chain transactions at a lower price, aiming to profit as prices rise. This typically happens before the coin is listed on centralized exchanges (CEX) and represents a form of primary market trading on-chain. At this stage, price volatility is extremely high, meaning both profit potential and risk are significant.

“Slippage—the difference between the expected price and the actual execution price—is a critical factor that determines success or failure in the sniping process,” Chen said.

"When sniping meme coins, the liquidity in the pool decreases, and prices rise rapidly. That's when slippage occurs. The price you see and the price at which miners package your transaction can differ by several multiples. If that happens, you won’t make money because you’re essentially buying at the peak," Chen explained.

To compete in this race against time, Chen often pays higher gas fees to ensure his transactions are prioritized and processed faster than others. "On-chain transactions are prioritized based on gas fees. Whoever pays a higher gas fee gets their transaction packaged by miners first. When I see someone preparing to buy in with a large amount of capital, I quickly increase my gas fees to ensure my transaction is completed first, profiting from the slippage caused by their trade."

However, Chen noted that the competitive landscape has changed significantly. "In the past, you could write code to snipe trades, but now the costs are extremely high. Running a node can cost thousands of dollars per month. The competition now resembles a hardware arms race, much like AI algorithms—success depends on equipment and node speed."

After years of engaging with cryptocurrencies, Chen has amassed extensive experience and developed a deep understanding of the industry. He observed that many newcomers still know very little about blockchain technology, its principles, and the opportunities within it. It was the “sense of isolation during the pandemic” that motivated him to become a knowledge-sharing content creator.

Over the years of engaging with cryptocurrencies, Chen has gradually accumulated a wealth of experience and a deep understanding of the industry. He realized that many newcomers still know very little about blockchain technology, its concepts, and the opportunities within it.

The "loneliness during the pandemic" became the catalyst for him to start his journey as an educational content creator.

"Back then, during the lockdown, there was no one to talk to," he said. "A lot of people didn’t even know what DeFi (decentralized finance) was or understand the concept of decentralization. I was just stuck in my room with the overwhelming sense of boredom, so I thought about sharing something on Bilibili to chat with others."

By sharing blockchain knowledge, Chen gradually attracted nearly 10,000 followers who were interested in cryptocurrency and blockchain technology. He even formed genuine connections with some of them and found many like-minded friends. He mentioned that many of these friends benefited financially from his insights into the cryptocurrency space, with some even expressing their gratitude by sending him red envelopes.

"I once donated half of the earnings from Bilibili and the money some of my followers gave me to the people in Daliang Mountains," he said, "hoping to do my part to help those in need and to express my gratitude to the friends who have supported me along the way."

Chen shares crypto knowledge on Bilibili, gaining nearly 10,000 followers.

Pro Researcher in the Investment Game: Uncovering Insights in Trends and Handpicking the Right Tokens at Right Times

Cici, 27, currently based in Singapore, is the Head of Investment Research at a cryptocurrency fund specializing in secondary market investments. She is also a personal investor passionate about exploring the crypto market. After graduating from university in 2020, she joined this company, officially starting her journey in cryptocurrency investment.

Cici said that her primary investments include Bitcoin, Ethereum, and tokens within the top 100 by market capitalization. At the same time, she also focuses on smaller-cap projects with solid fundamentals. The core factors supporting a token’s intrinsic value fall within the scope of fundamental analysis, such as the project team’s background, tokenomics, market demand, and fund distribution. These elements together determine a project's potential and stability.

At the beginning of 2024, Cici and her team had an optimistic outlook on the market. By analyzing the distribution of holdings (chip structure), market capitalization, and market sentiment, Cici identified six larger-cap meme coins and purchased them at very low prices during the market's downturn.

"One of the tokens I picked was Dogecoin. My reasoning was partly due to Elon Musk's frequent endorsements, and also because it's the king of memes. We figured that if the market performed well, it was bound to go up."

In April 2024, Elon Musk posted a tweet about Dogecoin on X, saying that it needs to be reported by the mainstream media as one of the top ten cryptocurrencies. After a series of similar posts promoting Dogecoin were published, its price soared by more than 4%.

The strategy paid off. These six tokens brought significant returns to both Cici and her company, with the best-performing token achieving a 12x return and even the least-performing one delivering a 50% gain.

Although meme coins lack any practical utility beyond speculation, they possess a "wealth creation effect" akin to the logic of buying a lottery ticket. "Stories of getting rich overnight make headlines, attracting even more people to join the market," Cici said.

"I've seen people strike it rich overnight by buying the 'golden dog.' Luck is important, but these individuals often put in serious research—they look at where the capital is flowing and how much smart money is buying in."

As the most prominent "golden dog" at the start of 2025, Trump Coin created a massive buzz, and Cici capitalized on this wave to reap her share of the profits.

Elon Musk urges mainstream media to acknowledge Dogecoin as a top ten cryptocurrency in his April 2024 tweet.

Trump Coin ($TRUMP) was officially launched on January 18, 2025, just before Donald Trump’s return to the White House for his second term. The coin generated immense hype, with its 24-hour trading volume surpassing $10 billion. After its launch, $TRUMP saw a rapid surge, starting from an opening price of $0.1824 and reaching an all-time high of $75.35 in less than 24 hours.

However, its price experienced a sharp decline in the following days. By February 2, 2025, the price had dropped to around $21, marking a 72% fall from its peak.

Trump Coin ($TRUMP) launches on January 18, 2025, ahead of Donald Trump’s return to the White House.

Despite the dramatic volatility, Cici managed to seize the opportunity during its initial surge and benefited from the hype surrounding this trending meme coin.

Cici woke up that Saturday morning and saw the news about Trump launching his cryptocurrency.

"I saw Trump’s tweet about his coin, and it had already been up for two hours. I immediately knew this wasn’t a hoax," she said.

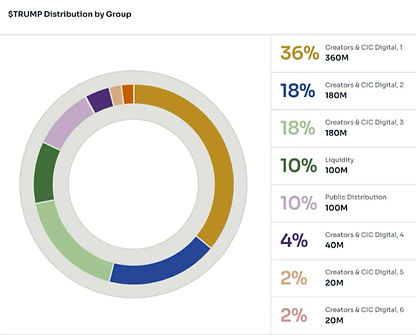

Based on her investment research team’s analysis, Cici realized that Trump Coin was not just an ordinary meme coin. "Its fundamentals were strong. The control was in the hands of Trump’s own company, which held the majority of the tokens," she explained.

According to the official description from Trump’s team, about 80% of the tokens were allocated to two Trump-affiliated entities: CIC Digital LLC and Fight Fight Fight LLC, subsidiaries of the Trump Organization.

About 80% of Trump Coin tokens go to two Trump-affiliated entities: CIC Digital LLC and Fight Fight Fight LLC.

Cici made her move when the token was priced at $12 and sold her holdings at over $70, achieving an approximate 6x return in a few hours.

In the face of a volatile market, Cici emphasized the importance of "emotional management" for traders. "Don't blindly enter the market due to FOMO(Fear of missing out), and don't impulsively chase highs. Many investors who entered Trump Coin at its peak are now deeply trapped, which is a typical consequence of emotional decision-making in the market”.

“It is crucial to remain rational and adhere to a clear investment strategy. Only by doing so can one maintain a competitive edge in the fiercely competitive investment environment,” Cici added.

Early-Stage Alpha Hunter KOLs: Building and Growing Together with Communities

Frank Jiao is a 21-year-old college student also an on-chain "Alpha Hunter(打土狗)" enthusiast, an active KOL in the niche of hunting underdog tokens on X and also the group owner of a Telegram community with over 3,000 members dedicated to exploring these tokens.

Those underdog tokens(土狗币) or meme coins always refer to newly launched, low-profile tokens that lack the backing of mature projects or substantial recognition. These tokens often have not undergone rigorous scrutiny and may not even have a clear real-world use case.

However, due to their extremely low prices and high potential returns (e.g., skyrocketing 100x or even 1,000x), they attract the attention of many speculative investors. “It’s like a high-risk gamble. Investors hope to achieve substantial returns by betting on tokens with explosive potential, but the majority of these tokens ultimately lose their value,” Jiao said.

In July 2024, Jiao began exploring on-chain token investments, particularly focusing on these newly launched tokens. Among these tokens, some are officially released by project teams, but the space is also rife with high-risk "pump-and-dump" schemes or outright scam tokens.

After stepping into this field, Jiao became fascinated by the transparency of on-chain data. Jiao said, "Everything on-chain is transparent. You can analyze the authenticity of a token through wallet connections, fund flows, and more. For instance, checking whether the holding addresses are clean or if the trading volume is unusual."

“While these methods can't guarantee 100% accuracy, they can effectively help avoid obvious scams,” he added.

However, high risk comes with high rewards. “Actually 99% of these kinds of tokens eventually go to zero. But it’s exactly this low success rate combined with the potential for high returns that keeps people excited," Jiao said.

Fueled by the wealth-creation effect, many investors hold onto dreams of striking it rich, hoping to find their very own "golden dog."

"If you participate in every project you find promising, eventually there will be a chance you can hit a 100x or even 1,000x token. Once that happens, the returns from that single project are enough to cover all your previous losses," Jiao said.

But Jiao also struggles to escape the "gambling mindset" brought about by this investment model.

"When the market seems to be performing well, I often tell myself to stay up just two more hours. What if I find a 'golden dog' during those two hours? So I can’t bring myself to go to sleep. However, more often than not, those extra two hours end with nothing to show for it," he said.

This mindset keeps Jiao feeling hooked all the time. He noted that it also harms both his sleep habits and his overall state of well-being. “I feel like I haven’t handled this aspect particularly well," he admitted.

When Jiao first started hunting for tokens on chain, he didn’t focus on managing his personal account. As he delved deeper into the field, he recognized how crucial it is to build a personal brand.

He began sharing his project analyses and risk warnings about tokens on X, hoping to increase his visibility and reach more people.

In the crypto asset industry, the X platform is showing a strong "traffic siphoning effect." According to ChainCatcher and Blocktempo’s report, 87% of investors rely on the platform to obtain industry information, creating a natural traffic pool for content creators.

Within just a few months, Jiao's X account gained over 5,000 followers.

Speaking about the reasons behind this rapid growth, he said, "these tokens inherently come with traffic. When you post content about a related token, people searching for it will come across your posts. This brings a lot of exposure to your account."

However, for certain reasons, his social media account was banned by X, causing a significant loss of followers, as most of them didn’t migrate to his new account. “This made me realize that user retention and consistent output are the keys to building personal influence. People follow you not because of temporary hype but because you provide them with value,” he said.

In the second half of 2024, with the emergence of many viral tokens, Jiao began posting his analysis of promising tokens on social media. “I always pinned the group link in my tweets, and users would join the group to get updates or participate in discussions as soon as possible.”

Frank noted that the group’s activity stems from members' interest in early-stage projects, with most interactions happening organically. He doesn’t need to deliberately guide user engagement in the group.

“This motivation to get information as quickly as possible often comes from the fear of missing out (FOMO). But it can also lead to impulsive investments. We always emphasize repeatedly that investments carry risks, and everyone needs to invest rationally and take responsibility for their own decisions,” he said.

Through daily voice chats and project discussions, Jiao gradually built trust and felt a sense of closeness with the group members.

Although the community hasn’t yet engaged in any commercial collaborations, Jiao is optimistic about his community’s future. He hopes to explore more directions through communication and suggestions from community members while improving user retention and the community’s overall health.

“In my view, everything ultimately needs to return to the users themselves—listening to their genuine thoughts and needs,” Jiao added.

Newbie's Guide to “Paying Tuition” in Crypto

Garth Yang, a 19-year-old freshman studying Business and Data Science at PolyU, took his first steps into the world of investing with a starting capital of 10,000 yuan. Half of this amount came from his parents, who wanted him to gain early exposure to the investment field and build experience, while the other 5000yuan was his own money. This initial fund marked the beginning of his exploration into the stock and cryptocurrency markets.

At the start, Yang's approach was purely based on intuition. “At first, I was just buying randomly. In the first couple of days, I even made some profits—around $100 in a day.” This small and seemingly easy victory excited him, but it didn’t last long. Soon enough, he encountered losses.

“One day, I suddenly lost 1,000 yuan. At that moment, I realized the money earned by luck could also be lost by luck,” he reflected. Determined to take investing seriously, Yang decided to learn how to analyze. He began searching for tutorials on YouTube about candlestick charts, aiming to use technical analysis to guide his decisions.

After a few days of studying, Yang felt his ability to make judgments had improved, and he experienced his first “significant victory”.

“That morning at 9:30, the coin price broke below the support level. Based on the ‘33 Principle’ summarized by a YouTuber, three consecutive candlesticks had closed below the support level, which I interpreted as a true breakdown.” He thought the pattern was almost textbook perfect. Confident in his analysis, he shorted the market decisively after a minor rebound. As a result, he earned 2,000 yuan from the trade.

However, this success proved to be nothing more than a fleeting stroke of luck. Yang failed to recognize that the complexity of the market far exceeded the few "tricks" he had learned. In subsequent trades, he gradually realized that theoretical models did not always align perfectly with actual market movements, and the market's volatility often exceeded his expectations.

The moment that truly made him aware of the risks was during a high-leverage trade. Yang said that he once assumed the price of a newly listed coin would inevitably drop.

But once he was eager to short a new-listing token with high leverage, only to face an immediate liquidation. “After getting liquidated, I refused to accept the loss and kept adding to my position, trying to recover. In the end, I lost even more,” he said.

What shocked him even more was when a cryptocurrency influencer he had followed since entering the crypto space also faced liquidation. Garth explained that he had once regarded this influencer as his "wealth code," someone with an almost uncanny ability to predict market trends. However, during one trade, the influencer shorted a coin heavily, only to be liquidated when the market surged unexpectedly, resulting in losses of hundreds of thousands—or even more.

“I watched as he got liquidated so quickly that he didn’t even have time to add funds to his account. In that moment, I was shaken. If someone as skilled as him could end up like that, what chance did small players like us have?” Yang said.

This experience left him with a deep sense of powerlessness toward the market and a clearer understanding of his limitations as a beginner.

Two months later, Yang had only managed to withdraw just over 1,000 yuan from his initial 10,000-yuan investment in the crypto market. Despite this, he didn’t completely lose interest in cryptocurrencies. Instead, he decided to step back, take time to learn, and re-enter the market when he felt better prepared. He mentioned that in the future, he would likely focus more on spot trading rather than aggressively using leverage as he had done before.

The high volatility and complex rules of the crypto market gave Yang a clearer understanding of his own abilities. He began to realize that in this market, dreams and risks go hand in hand, and he was, after all, just another ordinary participant being wiped out by this game.

Following the ‘33 Principle,’ Yang shorts after a rebound and earns 2,000 yuan.

In the world of cryptocurrency—teeming with both opportunities and risks—everyone is playing out their own unique story. Some achieve financial freedom through deep technical expertise and sharp market intuition, while others strike it rich momentarily by sheer luck, betting on a "golden coin." Yet, there are also those who, driven by high leverage and impulsive trading, suffer devastating losses, getting reaped as 'newbies’.

For every participant, self-awareness gained through the process. Those who weather the market’s ups and downs might learn to cultivate calmness and rationality through repeated failures. Even the most successful cannot guarantee they will always remain undefeated.

Regardless of the final outcome, this game of wealth and risk is but one chapter in the larger narrative. Each person, through their trials and triumphs, pens their own story in this grand saga.

Riding the Web3 Wave: Navigating Careers with Growth, Freedom, Dreams, and Risks

On a typical morning, Zishan Feng, 24, walks briskly through Hong Kong’s bustling Central MTR station, holding her phone as she records her daily routine for her social media channel.

“Welcome to a day in the life of a Gen Z Web3 sales professional,” Feng says in an enthusiastic tone, delivering the signature opening line of her daily vlog. Her videos document the daily routines of a Web3 sales professional—meeting clients, presenting sales reports, and attending Web3 networking events after work etc.

After graduating with a degree in Data and Media Communication from Hong Kong Baptist University, she started her career as a data analyst. She later transitioned into finance, working in investor relations for a crypto secondary fund, managing high-net-worth clients.

Today, Feng works as a VIP client manager at Hashkey, a licensed crypto exchange in Hong Kong, focusing on high-net-worth and institutional clients. Outside of work, her Xiaohongshu account has tens of thousands of followers, where she has built a personal brand and a valuable professional network in the decentralized world.

“I want to use my platform to showcase the vibrant and dynamic world of Web3, helping more people understand this industry,” Feng said.

Amid the global wave of digital transformation, the Web3 industry is growing at a remarkable pace, gradually transitioning from a niche field to the mainstream. Over time, with the implementation of policies in various countries, the level of regulation within Web3 has steadily improved, injecting more trust and legitimacy into the industry.

These changes have attracted a large influx of talent, including professionals transitioning from the traditional Web2 sector as well as fresh university graduates entering the workforce for the first time. However, the professional ecosystem of this emerging field presents both opportunities and challenges: it offers flexible working patterns, immense potential, and vast career growth opportunities, but also faces a highly dynamic market.

According to Tracxn, there are over 29,000 companies operating within the blockchain, cryptocurrency, and the broader Web3 ecosystem globally. Of these, more than 9,000 have received funding, collectively raising $81.3 billion in venture capital and private equity investments, creating a significant demand for talent.

In January 2024, the U.S. Securities and Exchange Commission officially approved the first Bitcoin spot ETF (Exchange-Traded Fund), marking a milestone that allows investors to trade Bitcoin as easily as stocks or mutual funds in their daily transactions. Six months later, the SEC approved applications for nine spot Ethereum ETFs, further demonstrating the increasing acceptance of virtual currency assets by regulatory authorities.

While the cryptocurrency market has long been criticized for its volatility and regulatory uncertainty, these approvals are seen as a critical step toward the industry's maturation.

With growing optimism about the future of the market, recruitment activity in the Web3 industry has significantly heated up. According to a report by Tiger Research, the number of global Web3 job postings in the first half of 2024 increased by approximately 20% compared to the same period last year.

As a Business developer at HashKey, Feng attends Consensus HK to meet clients and expand business.

The approval of the Bitcoin spot ETF was also the catalyst for Feng’s decision to join the Web3 industry. “When I saw the news, I felt that crypto had officially entered the mainstream financial system,” Feng said. “It was a decision that followed the trend of the times and seized the future.”

Feng's work at the crypto exchange primarily focuses on institutional and high-net-worth clients, handling account opening, trading, and fund deposit and withdrawal services, particularly the conversion between digital currencies and fiat currencies.

Their VIP clients typically need to meet strict funding requirements, such as maintaining liquid assets of at least HKD 8 million over the past three months. Feng said these clients have high expectations for fund security and regulatory compliance, making trust the most crucial aspect of the sales process.

As the core hub of the cryptocurrency industry, exchanges are not only liquidity centers that provide lower barriers to entry for both retail and institutional investors but also play a critical role in resource allocation and regulatory pathways. For instance, project teams need to list their tokens through exchanges to gain greater exposure and support.

With more exchanges obtaining regulatory licenses, they are increasingly becoming the bridge between digital currencies and fiat currencies, offering clients secure and legal fund conversion services. Users can use these exchanges to inject fiat funds into the crypto market or convert digital currencies into U.S. dollars or Hong Kong dollars.

Feng said, “Selling exchange’s services is challenging at every step. From finding clients and understanding their needs to convincing them to choose us over competitors, it all requires time and patience. These high-net-worth clients are often concerned about fund security and question whether the services can comply with regulations. We need to win their trust through professional explanations and a strong sense of responsibility,” he said.

Industry conferences like Consensus or Token2049 are Feng’s primary venues for meeting new clients and establishing initial connections on a large scale. While sharing short video content about Web3 industry insights as a social media creator, Feng's clients can further explore his background and professional expertise through her videos.

“I might add hundreds of people at a single conference, but there’s not enough time to engage deeply with everyone. Social media breaks the limitations of time and space, giving clients an opportunity to better understand my professional background, personality, and area of work,” Feng said.

“The identity of a creator helps establish a personal brand and professional image, which is also crucial. In this industry, people are highly vigilant because there are a lot of scammers,” she added.

This combination of online and offline approaches has become an important supplementary tool for business development. “Compared to offline interactions, social media has a much broader reach and longer-lasting influence. A high-quality video can attract tens of thousands of views and create a positive impression, which could translate into my potential clients,” Feng explained.

As a Web3-focused content creator and industry professional, Feng is optimistic about the future of Web3. He believes that the current level of Web3 adoption is still in its early stages, but with the gradual advancement in technology and awareness, explosive growth is inevitable.

“I think Web3 today is like the internet industry in the early 2000s. By sharing industry insights and personal reflections on social media, I want to use my content to help more people understand the potential and value of Web3,” Feng said.

Michel Cui, 40, left Alibaba at the beginning of 2024 when his career in the traditional internet industry had reached its peak, to join a public blockchain project, AIOZ, as the VP of Global Partnerships & Investment.

“I initially went to France to study at an engineering college, but my career direction has constantly evolved. From R&D roles to becoming a business consultant at Atos, and eventually joining Alibaba Cloud in Europe and then Singapore, I’ve been exploring what I truly want at every step.”

As Chinese companies expanded globally, Cui seized this wave of opportunity and joined Alibaba’s international team, becoming one of the core members of its founding team in Europe. He was responsible for market expansion in the Benelux region (Belgium, Netherlands, Luxembourg), as well as overseeing tech-related partnerships in areas such as DAMO Academy, Alibaba Cloud, and AI technologies.

“During the pandemic, I could feel that the European economy had slowed down significantly, but the Asia-Pacific region remained relatively active. So I applied to transfer to Singapore. From 2020 to 2024, I primarily focused on building Alibaba’s Web3 ecosystem,” Cui explained.

Over those four years, Michel’s team supported numerous Web3 projects within Alibaba’s ecosystem, helping them incubate, secure funding, and expand into broader markets.

"During my years at Alibaba and my exposure to the Web3 industry, I’ve become increasingly convinced that Web3 is one of the brightest tracks for the next 10 to 20 years," Cui said.

"Web3 is not just about tokens or short-term speculation. It’s a technology-driven field that can bring long-term value to businesses. This space is brimming with technological innovation and an influx of capital, creating endless possibilities for global technological and business model transformations."

"However, only by truly joining a Web3 company can you fully understand the ecosystem’s logic and innovative mechanisms from the inside out. That’s why I decided to leave Alibaba and join a public blockchain," he explained. "Large internet companies’ exploration of Web3 is more about partnerships rather than a complete transformation, and they haven’t fully embraced the decentralized spirit of Web3."

"I don’t like the idea of ‘lying flat.’ I prefer to be part of innovative projects, engage with pure Web3 entrepreneurs, and drive interesting and meaningful initiatives," Cui said.

In 2024, Michel decided to join AIOZ Network, a project he encountered during his time at Alibaba. AIOZ Network is a public blockchain focused on decentralized physical infrastructure networks (DePIN), AI, and streaming technology.

Cui believes that the true potential of Web3 lies in using technology to drive societal progress. "Through decentralized technologies, Web3 can break the centralized barriers of traditional systems and extend resources and services to more underserved regions around the world, narrowing the technological gap," he said.

Cui said that currently cloud computing data centers from giant tech companies like Amazon, Google, and Alibaba are typically concentrated in major cities and developed countries with robust backbone networks. However, for underdeveloped regions such as Africa and Latin America, these services are often out of reach.

"But with DePIN and edge node technology, we could provide more Web3-based technical support for businesses in non-developed countries," Cui explained.

"By leveraging edge nodes, we hope we can empower these regions, not only exposing them to cutting-edge technologies but also lowering technical barriers through the distributed deployment of edge nodes,enabling these regions to access AI computing power."

"Web3 is a fertile ground for innovation, where we can see endless possibilities and drive technology to shape the future," Cui said.

In addition to his strong confidence in Web3's long-term vision, Michel is also satisfied with Web3's flexible work model and decentralized collaboration approach.

The core philosophy of Web3 is decentralization. By leveraging blockchain and distributed technologies, Web3 breaks traditional organizational structures and centralized power models, encouraging direct collaboration between individuals rather than relying on centralized intermediaries.

“This philosophy is not only reflected in the technological aspects but also deeply influences the work culture of the industry,” Cui said.

According to Metarficial, 53.39% of Web3 jobs currently operate in a remote work model. The flexibility of remote work eliminates traditional geographical and time constraints, enabling teams to collaborate efficiently across time zones and without the limitations of conventional office setups.

Cui said: "The Web3 work model allows people to participate in global collaboration in entirely new ways. Our team mostly adopts a remote model and has gradually moved away from the traditional hierarchy. Everyone earns rewards based on their contributions rather than relying on traditional rank-based allocation."

The Web3 work model holds immense appeal for people like Cui who have transitioned into the Web3 space. “Its flexibility and openness allow individuals to strike a better balance between work and life,” he said.

In 2024, Michel joins AIOZ Network as VP of Global Partnerships & Investment, focusing on DePIN, AI, and streaming technology., focusing on DePIN, AI, and streaming technology.

Similarly, Harry Zhang, 28, who also came from a Web2 tech giant and now works as a backend developer at a cryptocurrency exchange, finds the freedom of remote work deeply attractive.

"I worked as a backend developer at Alipay before 2023. The work environment at Alipay was extremely toxic, with frequent late-night overtime—it was basically like a 'gladiator training arena from ancient Rome,'" Zhang said.

As a tech-driven company, Alipay's R&D team was often regarded as the "No. 1 position," meaning developers bore tremendous pressure. "The development work was exhausting, the intensity was overwhelming, and life was almost completely tied to work," Zhang said.

"Now, the workload is less than 1/10th of what it was before," he said. "I just clock in at 9 a.m. and clock out at 6 p.m. on our online system. It's much more flexible, and the pressure is significantly lower."

This work model has given him a renewed sense of freedom in life. "I’m no longer tied to a specific city. In the past, I had to rush back to my work city by the sixth or seventh day of the Lunar New Year, and every time it felt like I was being forced to leave. But now, I don’t have to anymore. I can stay in a place I love until I feel ready to move on."

At the same time, maintaining a low profile, strict confidentiality, and a high level of security has also become a part of the daily routine for professionals in this industry.

On the evening of February 21, 2025, Bybit, one of biggest cryptocurrency exchanges suffered a hacking attack, with estimated losses of $1.5 billion. During a routine transfer, Bybit detected unauthorized activity in its Ethereum cold wallet. Hacker manipulated the smart contract logic and concealed the signature interface, ultimately gaining control of the cold wallet and stealing assets worth $1.5 billion, marking one of the most severe thefts in cryptocurrency history.

On February 21, 2025, Bybit’s Ethereum cold wallet is hacked, resulting in a $1.5 billion theft.

"Our exchange repeatedly emphasizes the importance of confidentiality regarding personal information. We don’t even allow employees to exchange contact details with others in the same industry. This is out of fear of another incident like Bybit’s, fear of information leaks that could lead to being locked as a target by hackers," Zhang added.

In the highly sensitive cryptocurrency industry, the confidentiality requirements for professionals are closely tied to the "criticality" of their roles. Zhang explained that positions close with dealing with fund flows—like core programming, system maintenance, and quantitative strategies—face stricter security demands, which often influence work methods and office environments.

"Some Web3 companies with offline offices adopt partitioned office layouts to ensure information security," Zhang said. "Different departments are physically separated to reduce the risk of information overlap and to ensure sensitive data is not leaked."

While many have transitioned from Web2 to Web3 to seize new opportunities, the high volatility and uncertainty of Web3 still make young professionals hesitate when choosing their career paths.

The drastic market fluctuations, as well as the divide between traditional industries and Web3, often leave newcomers at a crossroads: on one hand, there is the choice of a stable but overly mature traditional path; on the other, the still-uncertain Web3 market, with its extreme volatility.

Dave Deng, a 20-year-old student from the Business School of HKUST, observed that Web2 and Web3 industries do not always recognize each other.

Although Deng has been deeply involved in the Web3 industry, he has yet to fully commit to it. "My experience in Web3 is actually quite extensive. I’ve worked as an intern in public blockchains and Web3 hedge funds and I’m also the president of 0xU, the largest cross-school blockchain club in Hong Kong. But if you take these experiences to traditional industries, like traditional finance or traditional internet companies, they don’t always value them. They have no idea about the significance of these experiences or how to evaluate them," Deng explained.

“Moreover, the cryptocurrency market is highly volatile and changes rapidly,” he said. At the end of 2024, following the announcement of the U.S. presidential election results, market expectations regarding U.S. cryptocurrency policies significantly increased, driving Bitcoin prices to soar past $100,000. However, the hacking attack on Bybit, coupled with growing investor concerns over U.S. macroeconomic policy expectations, led to a global capital market downturn. As a result, within just a week, Bitcoin's price plunged below $80,000.

"I'm studying economics, so I prefer to approach things from an economic perspective—calculating probabilities and actual returns," he said. "The returns in Web3 seem very high, but the risks are equally significant. I've experienced bear markets myself and have spoken with many veterans in the Web3 industry who faced career setbacks during bear markets. This has made me think more seriously about how to choose my future path. Traditional finance is still a potential career option for me."

"Web3 is indeed a very attractive direction, but its risks and market volatility make it unsuitable for everyone. This is a choice that requires rational consideration and balance," Deng added.

Empowering Gen Z: University Communities Shaping the Future of Web3

Dave Deng, a 20-year-old sophomore from the Business School of HKUST, could be seen at various side events of the Web3 event Consensus Hong Kong in February. He shuttled between these events, listened to the talks, networked with people in the industry, and took photos with his favorite KOLs. But there was one side event that was his home court.

Deng is no longer just a participant, but an organizer of the event. Deng is the president of 0xU, the largest cross-school blockchain club in Hong Kong. He led his organization to host the biggest Career Fair among the numerous events at Consensus Hong Kong 2025.

He calmly dispatched work on the spot and accurately controlled the rhythm of each link, from arranging the speeches of the guests to time management, to ensure the smooth progress of the event.

"I hope this event will help more university students realize the immense potential and opportunities hidden within Web3. And I’m thrilled to introduce more people to the cultural spirit of Web3 and encourage them to actively integrate into its communities," Deng said.

With the rapid development of cryptocurrency and blockchain technology, Web3, as the next generation of the internet, is drawing increasing attention from young people. Cryptocurrencies, as an emerging asset class, combined with the rise of decentralization and the emergence of numerous new opportunities, provide the younger generation with vast space for exploration and development.

Nowadays, more and more college students are beginning to understand and devote themselves to the Web3 field, joining or creating Web3 communities composed of like-minded people. In their spare time, they build online communities, organize offline activities, explore new insights, research new technologies, and bring fresh air to this industry in their own way.

According to Gemini, an American cryptocurrency exchange and custodian bank, GenZ (ages 18-29) are the bright newcomers in the cryptocurrency space and are the generation most interested and optimistic about this new financial frontier.

The decentralized world is made up of numerous Web3 communities, and Gen Z, as the driving force of Web3, is active in every corner of these communities. According to REZOLUT's research report, at least 30% of active users in Web3 communities are Gen Z, making them the fastest-growing user group—far surpassing Millennials in growth rate.

Deng's interest in cryptocurrency began in his first year of high school. When he was in Chengdu No. 7 Middle School, Deng took the blockchain elective course. In the first class, the teacher explained the origin and significance of Bitcoin, which made Dave very interested in this industry and the vision behind it.

The story of Bitcoin began in 2008, when Satoshi Nakamoto published a white paper describing a peer-to-peer electronic cash system that does not rely on banks or intermediaries. Its goal is to enable everyone to truly control their wealth without relying on centralized institutions. This bold concept has also become the starting point of the decentralized economy.

"What attracts me most about the cryptocurrency industry is not just the driving force of money, but the philosophy of Web3 - the concept of decentralization, openness and user autonomy," he said. This marked the beginning of his journey to explore this field.

Since joining HKUST, he has seized every opportunity to get close to or even create web3 resources and communities. He once took the lead in founding the only student-organized Web3 club at HKUST - CEN (China Entrepreneur Network) Web3 Club, which once had more than 120 members. Although he encountered a development bottleneck later, he met the members of 0xU, joined them and was elected chairman in April 2024.

As the largest cross-university web3 community in Hong Kong, 0xU Blockchain Club brings together active builders in the Web3 field and outstanding pioneers from universities. Its community currently includes more than 2,000 active WeChat group members and 3,601 Twitter followers.

As a blockchain club with the concept of decentralization at its core, the way it operates here is different from traditional clubs: there is no obvious relationship between superiors and subordinates, and there is no so-called "status", Deng said.

"When I was running for election, I didn't feel that I had to be the chairman, and I never thought that this was a position of 'power'. I just wanted to do something for the web3 community so that it could break the circle and let more people know its charm," he said.

The Web3 Career Day co-organized by 0xU is the largest offline event since he took office. The event attracted more than 700 college students from universities across Hong Kong to participate, where they learned about the recruitment information of major web3 exchanges and project parties.

The Web3 Career Day, co-organized by 0xU, is the biggest career fair at Consensus Hong Kong 2025, attracting over 700 Hong Kong college students to explore Web3 recruitment opportunities.

At 0xU, being elected chairman does not mean an easy journey. "The workload here is almost comparable to that of a full-time employee, but for me, the core driving force is passion and meeting more like-minded people in the process."

"This experience has allowed me to get in touch with many people who I can't usually get in touch with, and to establish more connections in the industry, which is very valuable," he added.

As 0xU president, Deng actively joins Web3 events and leverages the platform to build industry ties.

Nemo Hu, 20, a junior student majoring in data and media communication at Hong Kong Baptist University, said that participating in this event gave her a new understanding of the cryptocurrency industry.

Hu’s first encounter with 0xU was three years ago through a Bilibili livestream by 0xU, which sparked her interest in decentralized finance and blockchain technology," she said.

This career fair was Nemo’s first time to participate in an offline event of Web3, and she was surprised by its scale and quality.

“The event invited many industry authorities, such as Gracy Chen, CEO of the world’s top four cryptocurrency exchanges. I listened to their ideals and great gains in web3, and my curiosity and yearning for this industry ignited in my heart.”

She said that after chatting with several employers in the industry, she was surprised to find that these companies were very friendly to our interdisciplinary background students, not only limited to technical positions, but also event planning, marketing, front-end product planning and other opportunities. ” She said that this experience opened up new possibilities for her career choice.

In addition to new ideas for career development, Nemo also got in touch with many seniors in the web3 industry during the networking session and joined their communities. Among them was the "Web3 Sailing Deck Group" organized by a vice-chairman of the Tsinghua Chain Association, where members would share various web3-related information and job opportunities.

"Through these offline activities and online communities, I feel that the inclusiveness and diversity of the blockchain industry exceeded my expectations. It is not as far-fetched as I imagined," Hu said.

Also during Consensus, a team from Tsinghua Blockchain Association won an award in the Easy A Consensus Hackathon. This news attracted Hu's attention in the online group, revealing another image of the university student blockchain community, developers.

The Easy A Consensus Hackathon is an international hackathon event that attracts outstanding teams from around the world. This year's event was hosted by renowned public blockchains Aptos, Ripple, and Polkadot, aiming to inspire developers from various regions to collaboratively explore innovative applications of blockchain technology.

"We want users to be able to use our AI agent without worrying about questions like 'What to buy?', 'How much to buy?', or 'How much leverage to use?'” Wang said. “The AI agent will generate investment suggestions based on on-chain data and the user's risk preferences, dynamically managing positions by integrating with wallets."

During the demo presentation, the product showcased not only a functional frontend interface but also direct on-chain execution capabilities. “The judges were impressed with the product's completeness and functionality,” Wang said.

Wang’s team is still in the expansion phase and is already planning further collaboration with Aptos to optimize the product's features. Their ultimate goal is to build a truly usable DeFi investment management tool.

"The programming languages used for data analysis differ significantly from those used in development," she said. "But thanks to AI technology, I can quickly learn a new programming language — sometimes even within a single day — and turn my ideas into actual products." The high-intensity environment of creation and rapid realization excites her and has deepened her interest in applying blockchain technology in practical scenarios.

Wang, 24, transitioned from studying English and Financial Journalism at the University of International Business and Economics to pursuing a master’s degree in Data Communication at Tsinghua University.

Her interest in data visualization emerged during her undergraduate years, where she honed her skills by self-learning Python to create visual representations of data. After joining Tsinghua, she took on the role of Head of Research at the THUBA.

As a student-led organization, the Tsinghua University Blockchain Association (THUBA) traces its roots back to September 2017 . Its official media accounts have gained over 20,000 followers, and the events it has hosted have attracted over 100,000 participants. In September 2022, Tsinghua University was ranked 6th globally among universities with the most blockchain impact by CoinDesk.

The high-intensity environment of creation and rapid realization in hackathon competitions excites her and has deepened her interest in applying blockchain technology in practical scenarios.

She found that in blockchain communities, effort and reward are directly proportional. "The more energy you invest, the more opportunities you gain," she said.

"Many Web3 project teams prioritize recruiting our association’s members, as we already have some industry understanding, which helps reduce their training costs," Wang Ye explained. “These university blockchain communities offer students a low-barrier entry point into the industry.”

Wang Ye’s deeper understanding of blockchain's core philosophy was profoundly shaped by her immersive experience at the University of Southern California. During her time in the U.S., she also joined USC's Blockchain Association, where she was introduced for the first time to the real-world operational models of DAOs (Decentralized Autonomous Organizations).

"This is somewhat similar to how company shareholders participate in corporate governance," she explained. This experience provided her with valuable insights into how decentralized communities function and the critical role that young professionals and academic institutions can play in shaping the future of blockchain governance.

Wang discovered that many large VC firms and token holders often lacked the time and resources to manage their "voting rights." As a result, they would frequently delegate these rights to college student organizations or research-focused non-profits, allowing these groups to participate in project governance on their behalf.

"This is somewhat similar to how company shareholders participate in corporate governance," she added.

Uniswap, the largest decentralized exchange (DEX) on Ethereum, is a typical example,allowing UNI token holders to delegate voting rights to third-party agents.

As one of Uniswap's major investment institutions and the lead investor in Series A financing, a16z said that in order to increase the overall diversity of views in governance and reduce the concentration of voting rights in the entire network, it decided to entrust most of its voting rights in protocols such as Compound and Uniswap to qualified participants, including university student organizations, such as HarvardLawBFI, Blockchain at UCLA, Blockchain at Berkeley, etc.

This model revealed to Wang Ye another way for university students to participate in Web3 — as "builders" of public blockchains.

"The benefit is that you get to engage deeply with major public blockchain projects, not just on a technical level, but also in discussions about ecosystem development and philosophical ideas," Wang said.

This experience solidified her determination to continue exploring the blockchain industry, while also helping her realize that blockchain is not just a technology but a completely new model of social collaboration.

"The true philosophy of blockchain, though seemingly utopian, is about decentralization, transparency, resistance to traditional institutional control, and fairness. This is the future of Web3 I hope to see, and it's the direction I am working toward in this industry," she said.

"Perhaps years from now, when we look back, we’ll realize that this is a technological revolution. It’s just that many of those currently in the eye of the storm don’t yet realize that they are already part of the force driving this transformation," she said. "I believe even more people will join in the future."

Wang Ye and five other teammates from THUBA won the 1st Prize in the Aptos DeFAI Track during the two-day offline competition with their "Investment Assistant" AI agent, built entirely from scratch. This AI agent is designed to help users automate portfolio management and asset allocation.

THUBA team wins 1st Prize in the Aptos DeFAI Track with their "Investment Assistant" AI agent. Wang is third from the right.

THUBA forms in 2021 through the merger of the Blockchain Association of Tsinghua Students and the Tsinghua International Blockchain Association.